Want to Stop Overpaying on Your 1099 Taxes?

(Most Self-Employed Professionals Are Leaving Thousands on the Table)

Hey there, 1099 warrior –

Let me guess: Tax season feels like walking through a minefield with your hard-earned money on the line. Between tracking expenses in messy spreadsheets, stressing about quarterly payments, and wondering if you're missing major deductions... it's overwhelming.

Trust me, I get it. After helping hundreds of freelancers and contractors maximize their tax savings, I've seen how even small tax mistakes can put a serious dent in your income.

Here's the thing: If you're like most 1099 workers I meet, you're probably:

- Paying way more in self-employment taxes than you need to

- Missing key deductions that could save you thousands

- Worried about an IRS audit (but not sure how to prevent one)

- Struggling to time your quarterly tax payments right

- Letting healthcare and retirement planning eat up your profits

But here's the good news: A smart tax strategy can transform your bottom line – and it's easier than you think.

🎁 Here's Exactly What You'll Get When You Schedule:

INSTANTLY:

- The Complete 1099 Tax Mastery Guide ($397 value)

- A welcome email with your document checklist for maximum session value

- Bonus 2025 Tax Planning Calendar (Limited to next 10 bookings!)

DURING YOUR SESSION:

- A personalized review of your tax situation

- Clear action steps to reduce your tax burden

- Expert guidance on your biggest tax challenges

No complex financial jargon. No pushy sales tactics. Just practical, proven strategies to help you keep more of your hard-earned money where it belongs – in your pocket.

P.S. The moment you schedule, you'll receive your Tax Mastery Guide and document checklist via email. Don't miss out on the bonus Tax Planning Calendar – only 10 spots left!

Would you like me to adjust anything about how the deliverables are presented or emphasize different aspects of what they'll receive?

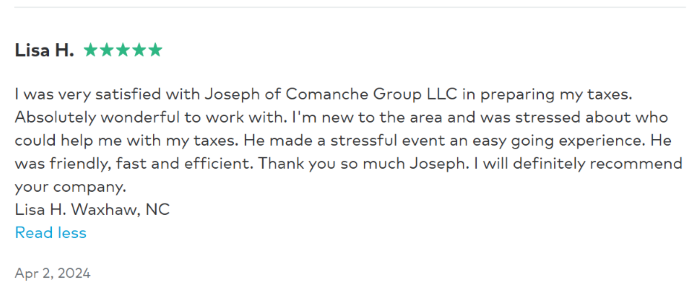

Check out our reviews

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.